This appeared in today’s newsletter. Subscribe here.

Cineworld, the UK-based cinema giant, is backing out of its $1.65B acquisition of Canadian cinema chain Cineplex. (Read more)

I wrote in this newsletter two years ago that cinema chains could be the basis for creating an “Amazon Prime of live entertainment”.

- Seeking a better biz model, cinema chains would launch subscription memberships giving consumers access to free tickets and discounts on concessions, like AMC Stubs program.

- These vertically integrated programs inevitably beat third-party ones like MoviePass (RIP) because they actually control the experience and have offer concession discounts (and deeper discounts). Plus the market is so concentrated that any consumer only has 1-3 options of cinema companies to go to…not much leverage for a third-party aggregator.

- These subscriptions target casual movie-goers (1-5 visits per quarter) who would start attending more (and spending more on concession) as a result of the subscription. In order to expand to the much larger swath of people who only go to cinemas 2-5 times per year, they’ll have to bundle their subscriptions with other live entertainment options.

- This bundle quickly becomes a competition to be the no-brainer membership to pay for in order to get discounts and special perks for whatever you and your friends want to do on a Friday or Saturday evening…tie-ins with other types of venues, with restaurant chains, with paintball or horseback riding or whatever else.

Amazon’s rumored interest in cinema chains while they are in desperate financial position during the Covid-19 crisis hints that they may see this too, with the additional reason that they could double cinemas as Amazon stores.

Cineplex is the most obvious company for an acquirer to test this thesis since it has 75% market share of Canada’s cinema market, has expanded into VR arcades, esports tournaments, and restaurant chains, and has 1/4 of all Canadian adults already in its free rewards program. It hasn’t launched a membership program yet or done enough to package its assets as one cohesive offering to consumers.

Interesting Deals, Stats, & Product Updates

Digestible Media

Film/TV/Video

- Snap announced a bunch of new Originals and renewed content deals for its Snapchat Discover section. (Read more)

- WarnerMedia is simplifying its confusing portfolio of SVOD apps. HBO Go will be shut down and users moved into the new HBO Max app for free. HBO Now is being renamed simply HBO and will the app for users whose smart TV devices (Fire TV, Roku) don’t yet offer HBO Max. (Read more)

- Bain Capital is preparing a $3.4B bid for a ~25% stake in Serie A, Italy’s pro soccer league, according to Bloomberg. The focus is securing a cut of the leagues annual income from selling broadcasting rights. (Read more)

- The offer competes with an existing one from CVC of $2B for ~20%.

- Serie A revenue in 2018-19 season was $2.5B, 60% of it from broadcast rights.

- Mediaset just filed an antitrust complaint in Italy against Sky Italia’s plans to broadcast Serie A matches on free-to-air TV rather than a subscription channel. (Read more)

Music

- Tencent did buy a $200M, 1.6% stake in Warner Music as part of Warner’s IPO. The negotiations had been reported at the time but not confirmed. (Read more)

- Tracklib, the Stockholm-based platform for music producers to legally and easily sample other songs, rasied $4.5M from Sony Innovation Fund. (Read more)

- The US music publishing market totaled $3.72B in 2019, up 11.6% yoy. It’s a stat that speaks to the growth investors like Hipgnosis, Shamrock, Kobalt Capital, and Round Hill have bet on with they aggressive buying up of publishing rights to hit songs the last few years. (Read more)

- The US recording music industry was $7.3B in 2019, by comparison.

- The US recording music industry was $7.3B in 2019, by comparison.

- The Norwegian government approved a data fraud investigation into streaming service Tidal. (Read more)

Podcasting/Audio

- Headspace, the subscription audio app for meditation and sleep, raised $47.7M in new funding. (Read more)

- Podyssey’s Podcast Deep Dives (Read more)

Interactive Media

Gaming

- AT&T is looking to selling Warner Bros Interactive, its gaming unit, for $2-4B. (Read more)

- “Take-Two Interactive, Electronic Arts and Activision Blizzard have all expressed interest” says CNBC

- “Take-Two Interactive, Electronic Arts and Activision Blizzard have all expressed interest” says CNBC

- Snap says 100M users have played a game on Snapchat since games launched in April 2019. (Read more)

- Kahoot!, the Oslo-based platform for user-generated educational games, raised $28M via private placement from existing VC backer Northzone. Another $62M in shares were sold in a secondaries transaction. (Read more)

- Kahoot! is listed on Norway’s Merkur, a sort of partially public market, with a full IPO expected in 2021.

- Current market cap: $1.4B // 2020 predicted revenue: $32-38M

- Playable Worlds, a San Diego-based studio building a cloud-native sandbox MMO, raised $10M in Series A funding from Galaxy Interactive and Bitkraft Esports Ventures. (Read more)

- A testing prototype of Ubisoft‘s forthcoming open-world game Gods and Monsters accidentally appeared for download on Google Stadia. (Read more)

- Playstation showcased its new Playstation 5 console, which will release around the holidays at the same time the Xbox Series X console launches. (Read more)

- WaPo had a good post comparing the companies’ strategies. PS is playing a traditional game, focused on a slate of expansive games developed in-house, whereas Xbox is focused on breadth by expanding its subscription service.

- WaPo had a good post comparing the companies’ strategies. PS is playing a traditional game, focused on a slate of expansive games developed in-house, whereas Xbox is focused on breadth by expanding its subscription service.

- Niantic, the studio behind Pokemon Go and Harry Potter: Wizards Unite, has 10 games in development with a plan to release 2 new games per year. (Read more)

- EA announced a new Star Wars game called Star Wars: Squadrons. (Read more)

- Cloud Imperium Games, a West Hollywood-based game studio, surpassed $300M in crowdfunding for its Star Citizen. (Read more)

- Star Citizen has been in development since 2011 and has had its public launch repeatedly delayed since 2014. Following an initial $2M Kickstarter in 2013, the team has continued to fundraise by pre-selling packages of digital goods that players will be able to use in the game. It hit $65M in 2014 and $200M in 2018.

- There is no official release date for the game.

- Here’s a Forbes story on the company a year ago.

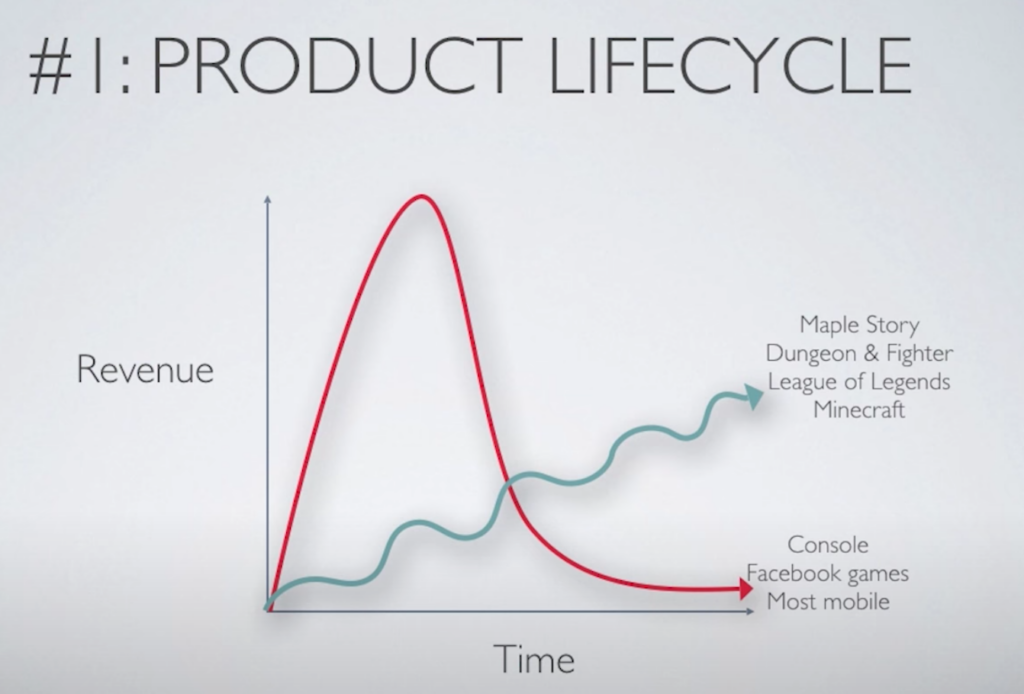

- GamesBeat interview with Andrew Chen, the partner at VC firm Andreessen Horowitz who leads gaming investments: Read it here

Someone asked me to clarify two terms I use near-daily in this gaming section: “open-world” means there is an expansive virtual world your character can wander around and do things in as you feel like…you’re not forced to stick strictly to certain missions in certain places. A “sandbox” game is a subset of that in which your character is specifically building and changing the virtual world…think Minecraft or Roblox.

AR/VR

- Snap now enables third-party developers who create augmented reality Snapchat filters via the Lens Studio tool to upload their own machine learning models. (Read more)

Communications

- Snap introduced Snap Minis, a way for third-parties to make small HTML5 apps that can be pulled up within Snapchat messaging. (Read more)

- Featured apps include buying concert tickets through Atom and creating flashcards with Tembo.

- Featured apps include buying concert tickets through Atom and creating flashcards with Tembo.

- Ethyca, a startup for managing data privacy compliance, raised $13.5M in Series A funding. IA Ventures led the deal, alongside a long list of angel investors including Mike Ovitz. (Read more)

- Reliance Jio sold more shares in its Reliance Jio Platforms division that is the largest mobile carrier in India, this time to PE firms TPG ($600M) and L Catterton. (Read more)

- It totals nearly $14B in deals (for 22% combined stake) in the last month with Facebook, Silver Lake, KKR, Vista Equity Partners, General Atlantic, Mubadala, and Abu Dhabi Investment Authority.