I enjoyed this 2017 talk by Nexon CEO Owen Mahoney to public market investors, arguing they look at gaming with the wrong mental models…that causes them to misprice gaming companies and causes gaming stocks to be overly volatile. (Thanks to Luke Constable at Lembas Capital for sharing it.)

(FYI – This post first appeared in today’s newsletter. Subscribe here.)

Mahoney breaks down 4 pillars for analyzing games:

- Product lifecycle

- Gameplay

- Retention

- New game development

#1 PRODUCT LIFECYCLE

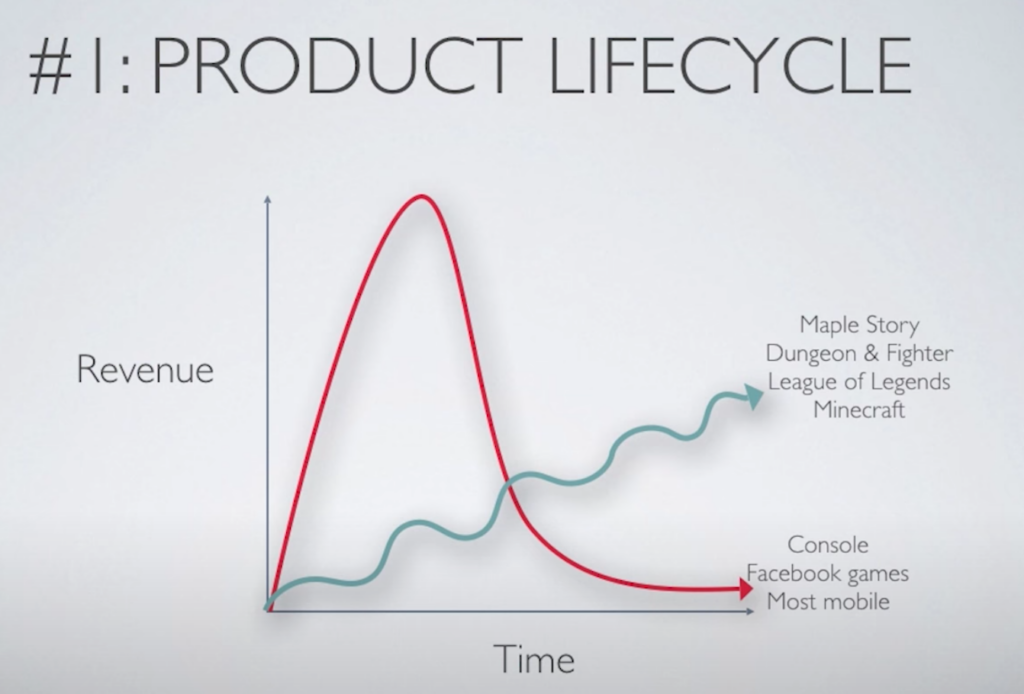

From a financial standpoint, massively successful games look more like SaaS than like movies, but investors treat them like movies. The most lucrative games follow the greenish-blue line in the graph below, not the red line.

What really sustains a game on the green line:

- Relentless content updates

- Characters, classes, maps, items

- An experienced online game co will spend 50-70% of total game dev spend on investment in live game development spend and will plan content updates a year out.

- Tuning and balancing

- If you make a single character or weapon overpowered, you ruin the fun and fairness between players. Players will leave.

- Robust virtual economies require management of the amount of in-game currency…economists on staff to control inflation.

- In-game events

- create timeliness, pop culture events to attend synchronously

#2 GAMEPLAY

Elements that lead a person to the desired Flow state:

- Meaningful work

- Clear goals

- Immediate feedback

- Cooperation

- Challenge, tuned to ability

Tuning the challenge level is critically important. A game needs to be easy to learn and hard to master. Too hard and players get frustrated (and leave); too easy and players get bored (and leave). Advances in machine learning make it easier to personalize each player’s experience to stay in that sweet spot.

#3 RETENTION

Paying more to acquire a user than you will earn from them (higher CAC than LTV) seems obviously wrong but its common in gaming, especially among startups raising money from VCs. It’s done to boost App Store ranking and show exciting revenue growth.

Metrics that really matter:

- What’s the average retention of a newly acquired user?

- What’s the eCPI (“effective cost per install”) vs. the LTV (“lifetime value”)?

- How do you calculate LTV? (Because that can be gamed)

- Are you acquiring new users from outside the Apple and Google app stores?

- What happened to new users after being featured in the app store? (Quick to churn?) How does user acquisition look when no longer being featured?

#4 NEW GAME DEVELOPMENT

The best games are completely different from anything else on the market when they come out. They are both really fun and really differentiated.

These are the games that remain popular for decades. Think: Tetris, The Sims, Final Fantasy, Dungeon Fighter, Minecraft, Civilization, Grand Theft Auto, Clash Royale, League of Legends…these are also the biggest all-time financial successes in the gaming industry.

Most of the industry takes a fast-follower strategy. Copy a game mechanic that really works. Fun but not differentiated. These games have low margins and short lifecycle. All the profits in gaming accrue to the few games that offered something truly new (and fun).

Here’s a public Google Doc with my notes paraphrasing Mahoney’s talk. Feel free to leave comments in there.